Special Report – Italy Published on

Special Report – Italy 🇮🇹

Live from the Market

Posted on January 10th 2024, written by Andrea Guolo et Silvia Manzoni

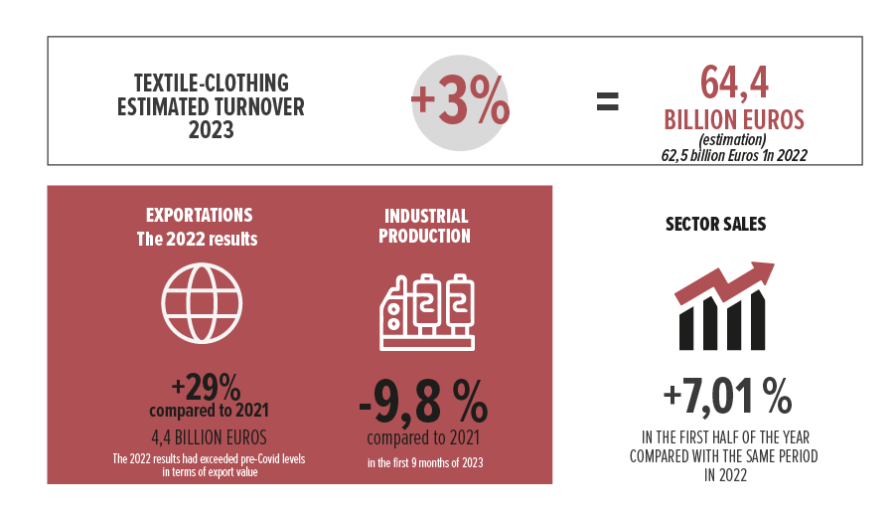

In spite of a strong start to the year, the Italian textile industry saw slowed growth in 2023, with the global economic context adversely impacting the robust gains seen in 2022. The industry’s 2022 results had topped pre-Covid levels in terms of export value (€4.4 billion, +29% versus 2021), on par with the particularly strong 2018 – which exceeded 2019, regarded as a benchmark year – with a turnover of just under €8 billion and production value of over €6 billion.

A report released at the end of November by the Centro Studi di Confindustria Moda for Sistema Moda Italia (an association of textile and clothing companies) confirmed that sales in the sector rose by an average of 7.1% in the first half of the year compared with the equivalent period in 2022. However, the figures covered both fabric and yarn companies and garment manufacturers and therefore cannot be directly compared with the above figures.

Declining Exports

With industrial production down 9.8% in the first nine months of 2023, the negative effect on sales strongly impacted the final balance sheet for the second semester and even more so figures for the start of 2024. The effects of this slowdown were also reflected in international sales results, particularly in France and Germany, the two leading destination markets for Italian fabrics.

Clothing Inventories Remain High

The slowdown began in April and became more pronounced in the latter part of the year. According to a report by strategy consulting firm PwC Italia, Italy’s textile supply chain was also impacted from the end of summer 2023 by the behavior of customers in the fashion and luxury sector. They were more cautious with new orders, especially for permanent products, for which inventories remain abundant.

“Even manufacturers who experienced relative growth in the resurgence of formal clothing are now experiencing a slowdown, following the success of the more casual styles that had taken hold since the pandemic,” says Omar Cadamuro, a partner at PwC Italia.

Sustainability, But Step by Step

Another aspect highlighted by PwC Italy is that demand for more sustainable fabrics, such as single-material products, remains largely on paper, especially regarding large volumes. Experimentation with recyclable and circular materials continues, although brands seem to be motivated more by other criteria including technical performance, the availability of new print styles and competitive prices.

“Even the advances made by the regulatory authorities are not enough to bring about a real change of regime, and the effect on environmental impact is still marginal,” cautions Cadamuro.

A Medium-Term Strategy

At industry level, operators are replenishing intermediate stocks, some of which had been completely depleted during two years of post-pandemic growth.

The aim of this replenishment is to maintain the capacity levels of factories which would otherwise be forced to reduce their workforce. In general, the long lead times in textile production linked to the cycles of natural and synthetic raw materials make it impossible to respond to short-term “schizophrenic” demand, hence the need to base strategies on medium-term forecasts, also in anticipation of a future upturn in demand.

The Italian textile industry cannot afford to resort to redundancies or social shock absorbers. At a time when the search for specialized staff is critical, there is a risk of losing valuable skills that are crucial to success, as a key element of innovation. These skills enable ‘Made in Italy’ to maintain a level of quality consistent with its top-of-the-range positioning, which is essential if it is to remain competitive and ensure its role as an industry benchmark in the global market.

According to PwC Italia, “Collaborations with technical institutes of higher education and a communication strategy aimed at promoting the sector and its know-how are some of the levers that can be activated by companies to meet these demands for excellence.”

Encouraging Synergies

Italy’s entrepreneurial fabric is highly fragmented, with a number of strategies at play: from the acquisition of suppliers by luxury holding companies to private equity funding and supply chain synergies of manufacturers of fabrics, leathers, components and fashion accessories.

“It is certain that the fragmentation of the Italian industrial landscape will allow other operations to be carried out in the future that could lead to synergies in terms of costs and operations and contribute to the managerialization of the sector,” concludes Cadamuro.

In other words, the number of companies will decrease, but those that remain will have a larger workforce and greater production capacity.

Ones to watch (very) closely…

Discover our selection of brands making waves on the Italian market

The eye of Tranoï

Tranoï, the trade show partner specializing in young international designers, shares its pick of emerging Italian-based brands to follow

ANITA BILARDI

Accessories / Bags

With a special focus on materials, the brand harnesses the versatility of nappa leather, denim, laminated leather and raffia to create casual bags with a sporty essence, designed for everyday life.

T_COAT

Ready to wear

Founded in 2019 by designer Massimiliano Legrenzi, this Italian brand entered the world of fashion intent on reinventing unisex outerwear.

The result: a collection with contemporary, fashion-forward silhouettes thanks to top-quality manufacturing and finishings, and details that make all the difference.