Special Report – Japan Published on

Special Report – Japan 🇯🇵

Live from the Market

As the economy picks up again, demand has been rising – but it’s still not at pre-Covid levels. In the apparel sector, exports are growing.

The daily trade newspaper Senken Shimbun put the total value of the Japanese clothing market at 8,884.7 billion yen in 2022, up 4.1% over the previous year. While this marked the second consecutive year of growth in both volume and value, the results still fall short of the 8.2% increase registered in 2019, just before the COVID crisis, and have yet to return to previous levels.

Full recovery still a way off

Available volume rose by 2.5% over the prior year, to 3727.7 million articles. Although this was the third consecutive year registering an increase, the level nonetheless remains below 4 billion articles, and still reflects a decrease of 6.4% compared to 2019. One key factor to bear in mind is stagnating demand, combined with an increase in the number of retailers looking to sell a limited quantity of items at the best price.

According to the Annual Household Expenditure Report released by Japan’s Ministry of Internal Affairs and Communications, monthly spending on clothing and footwear rose by 4.7% over the prior year, to 9,493 yen. While the downward trend is indeed slowing, monthly spending was nonetheless 16% lower than in 2019, meaning that a full recovery is still a way off.

This stagnation in consumption is expected to continue into 2023, while the fashion and textile sector overall is still in a recovery phase. This is a result of falling incomes and rising prices. Although wages rose by over 3% in 2023, average salaries in Japan have not increased for 30 years.

At the same time, consumer prices, outside of the prices for fresh food in Tokyo, have risen by 5%. As a result, real incomes are falling. According to several household surveys, spending on clothing and footwear continues to decline, while the market for second-hand goods is growing. In effect, consumers, to maintain their standard of living, are increasingly turning to stores and mobile apps that allow them to sell used items.

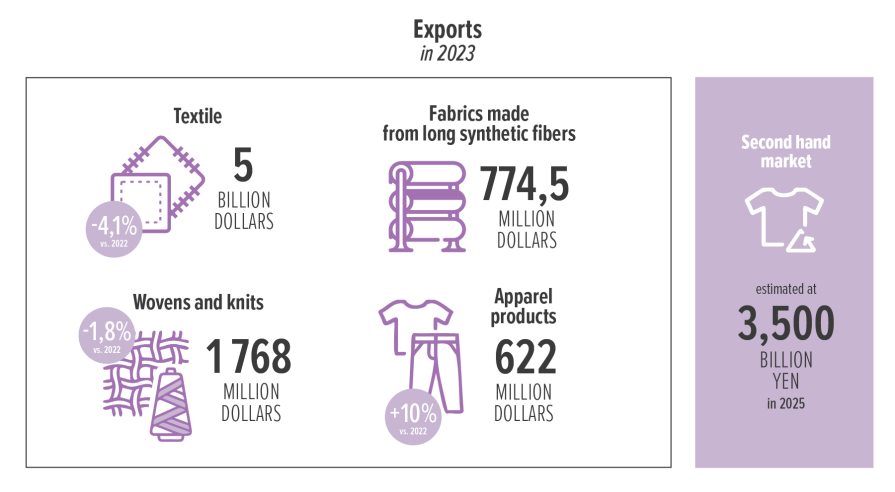

In 2021, the acceleration of the second-hand market led to an 11.7% rise over the previous year, reaching 2,700 billion yen. Clothing made up the largest category, totaling 458.7 billion yen (up 14.4% over the previous year), closely followed by luxury goods, representing 294.7 billion yen (up 19.6%). In 2023, this market is expected to reach 3,000 billion yen and 3,500 billion yen in 2025. If the current market for new goods is an artery for the fashion and textile sector, then the second-hand goods market constitutes its vital veins.

A rise in clothing exports

Faced with a stagnant domestic market and a rapidly depreciating yen, statistics show that more and more fashion and textile companies are turning to exports.

According to the Japan Textiles Exporters Association, textile exports for the first ten months of 2023 totaled $5,676,920,000, down 4.1% over the same period in 2022.

Fabrics made from long synthetic fibers were virtually unchanged at $774.5m, despite stagnating European and US markets. However, wovens and knits as a whole fell by 1.8% to $1,768,598,000. While some products experienced difficulties, such as raw materials (like cotton) and non-woven materials, apparel products registered a 10% increase, with sales of $622,889,000.

Japan has been a major and historic exporter of raw materials, yarns, cotton and textiles. Clothing products, on the other hand, have a structural trade deficit. It is worth noting, however, that there has been an accelerated move towards global markets, including Europe, the US and Asia, both for large companies as well as SMEs and brands.

Growing interest in textile SMEs

In the wake of the pandemic, textile SMEs also started to look overseas. Although Japan’s textile industry is in decline, the companies that have continued to protect domestic production are now drawing interest because of their technical expertise.

Sato Seni, a knit manufacturer based in the town of Sagae, is one of the most striking examples. Founded 120 years ago, the company is now the only wool spinner in the prefecture of Yamagata and one of the world’s leading manufacturers of combed wool yarn. Yarn exports, especially to Europe, grew after the pandemic, and production is now twice as high as it was before the COVID crisis.

Hasetora Bouseki, from the city of Hashima, Gifu Prefecture, has been in business for over 130 years. The company is also developing new strategies and making major investments.

It is working with innovative materials companies such as Spiber (based in Tsuruoka, Yamagata Prefecture) and Bioworks (based in Seika, Kyoto Prefecture). Both companies are developing structured proteins, with Spiber producing Brewed Protein, while Bioworks is developing PLA, biodegradable modified polylactic acids, known as PlaX™️. The aim is to advance the textile industry by positioning itself as an innovative manufacturer.

Japan’s only silk yarn manufacturer, Nakagawa Silk, based in Nagahama, Shiga Prefecture, has developed a washable silk called Prime Silk. Won over by the superior quality of the yarn, European luxury brands and Japanese designers have exploded the demand for this fiber, pushing the company’s production capacity to the limit. A new factory has been put into service to absorb this demand and meet a range of innovations.

Sumiko WAKASA

Editor in Chief, Senken Shimbun

Ones to watch (very) closely…

Discover our selection of brands making waves on the Japan market

The eye of Tranoï

Tranoï, the trade show partner specializing in young international designers, shares its pick of emerging Japan-based brands to follow

CATHRI

Ready-to-wear

CATHRI incorporates the Japanese technique of Kurume Kasuri, an intangible cultural asset of national importance. Timeless, universal loungewear from Japan.

CATHRI explores the magnificent techniques of Kasuri through its unique designs, which aren’t found anywhere else in the world.

HIZEN JEWELRY

Accesories / Jewelry

Ceramics from HIZEN, a region of Japan, are regarded as jewelry.

The five symbolic ceramics – Arita-ware, Imari-ware, Karatsu-ware, Ureshino Yoshida-ware and Takeo-ware – are appreciated as Japanese folk art and inspire the brand.

EVAM EVA

Ready-to-wear

“Spend your daily life in comfort.

What you wear, what you eat, what you desire and what you choose are all expressions of your own life and your own lifestyle.

Our know-how began with simply cut sweaters in high-quality materials. Since then, we’ve gradually added more and more items, and we continue to make objects we’d ourselves like to own in our daily lives.”